The President of the Association of Customs House Agents, Ghana (ACHAG), Yaw Kyei has predicted that the cost of doing business will increase as a result of the complete reversal of the discount policy placed on import values of general goods and home delivery values of vehicles during the payment of duties at the ports and frontiers of Ghana.

This he anticipated, will inevitably affect the cost of consumer products on the market.

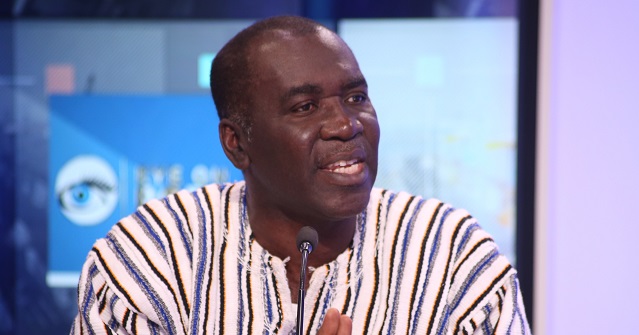

The President of ACHAG made his thoughts known during an Eye on Port panel discussion on the impact of the complete reversal of the discount policy on doing business in the country.

“Some of these wholesalers and retailers have the 30% discount absorbed within their profit base, now the reversal will cause a reduction in the profit margins and they will consider increasing the prices to recover the profits,” Mr. Kyei expressed.

It will be recalled that, the Government of Ghana, through the Customs Division of the, Ghana Revenue Authority in 2019, applied a 50% discount on duties payable on all general goods and 30% discount on vehicles to encourage more importation and tax compliance as well as alleviate the economic burden on the trading and consuming public.

This discount was further reduced to 30% and 10% respectively in 2021. However, beginning January 1, 2023, the discount policy has been scrapped.