Worsening port congestion has removed more than 2% of container vessel supply since March, according to a new report from Bank of America, citing Singapore, Dubai and the Mediterranean as congestion hot spots, while Asian box availability remains tight.

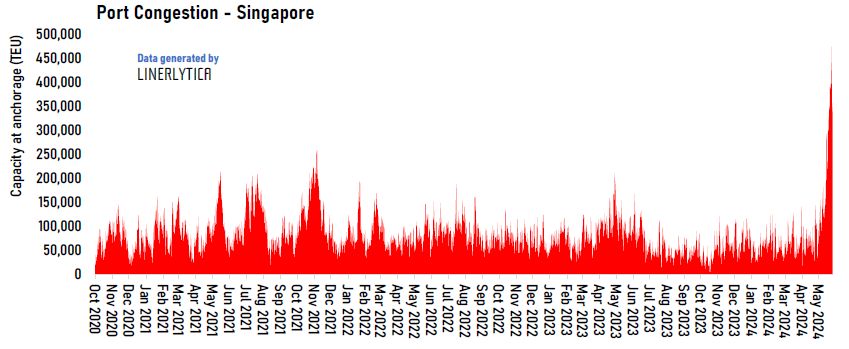

“Port congestion has returned to haunt the container markets, with Singapore becoming the latest chokepoint,” warned a new report from Asian container consultancy Linerlytica, which notes berthing delays are now up to seven days at the world’s second largest container port with the total capacity waiting to berth rising to 450,000 teu in recent days.

“The severe congestion has forced some carriers to omit their planned Singapore port calls, which will exacerbate the problem at downstream ports that will have to handle additional volumes,” Linerlytica pointed out.

The delays have also resulted in vessel bunching.

Shanghai and Qingdao are also experiencing a huge build-up of boxships at anchor. Dwell times at Shanghai, the world’s largest boxport, are now at three-year highs.

“The port congestion in Asia and the sudden surge in demand now soaks up even more capacity – capacity which the market does not have,” analysts at Sea-Intelligence suggested in their latest weekly report, adding: “Carriers are blanking sailings, not in attempt to restrict capacity, but simply because they do not have free vessels to maintain weekly services, when vessels get stuck in congestion.”

Splash247.com